Cryptocurrency Statistics 2021-2020 through 2017-2018

Cryptocurrency markets are truly fascinating. Even though cryptocurrencies don’t inherently have any value, investors and consumers alike have both added high dollar values to Bitcoin and its alternatives – altcoins.

While Bitcoin is unarguably worth more than any other cryptocurrency on the market, even when one doesn’t take its current dollar value into consideration and only thinks about potential growth in the coming twelve months, it’s also likely the most valuable. Source: However, the cryptocurrency market at large has been shaken up in a positive sense since Bitcoin’s price began to skyrocket roughly six months ago.

Here are nine eye-opening statistics related to the field of cryptocurrency, Bitcoin, altcoins, and a handful of aspects of trade inherently linked to them.

Crypto Statistics 2022-2021

Although Mining Bitcoin Is Expensive, Total Rewards Make It Lucrative

Mining Bitcoin in 2022, or verifying transactions by using computer power, electricity, and bandwidth to crack encrypted codes, is incredibly expensive to have the slightest hopes of turning profits. However, with sizable initial investments and an aptitude for learning the market, it’s possible to earn substantial returns. ( MinerHosting.net source Bitcoin Mining Statistics 2022)

According to Bitcoin.com, total mining rewards in the past 24 hours total a whopping $12,800,000.

It’s worth reiterating that beginners with little capital outlay to invest in mining Bitcoin or any other cryptocurrencies should refrain from doing so. Although trading Bitcoin itself is inherently risky due to the nature of cryptocurrencies as investments, it’s always a safer bet for those without extensive experience in information technology or computer science, and individuals without loads of cash to be comfortable with throwing away in the proverbial garbage can.

Which Cryptocurrency Exchange Is The Largest?

When people travel to foreign countries, airports and other organizations offering services related to traveling typically have currency exchanges nearby. Further, these currency exchanges are typically operated at reasonable rates that all travelers should be able to afford, unlike all cryptocurrencies.

Today, Bitcoin transactions can cost substantial fees, though that’s due to the slow nature of verifying transactions and the sheer interest in the “father of all cryptocurrencies.”

Currently, Bitfinex is the world’s largest cryptocurrency exchange in terms of global market share, hogging a commandeering 18 percent from the competition.

In comparison, Kraken and OkCoin are both ranked in 2nd place, each at 12 percent of global market share.

Initiating New Cryptocurrencies’ Foundations Isn’t Terribly Difficult

While not everybody can start a successful cryptocurrency, several initial coin offerings (ICOs) throughout the year have raised hundreds of millions of dollars each, altogether totaling billions of dollars, in terms of the United States Dollar.

Filecoin weighs in at the heaviest spot on the top-ten list of ICOs of 2022-2021 with slightly over a quarter-million dollars raised, at $257,000,000.

Of the 235 total ICOs, Tezos, EOS Stage 1, Paragon, and Bancor come to the ranking listed in 2nd, 3rd, 4th, and 5th places, respectively. The five aforementioned initial coin offerings, all of which took place in 2017, secured at least $153,000,000 in funding, as 5th-place Bancor did.

Ethereum Shows Promise

In 2020, the price of Ether rose from under $10 per unit to more than 1,000 times its original value – in percentage terms, that’s a whopping 10,000-odd percent!

While it’s safe to say most cryptocurrency “experts” – as if there could be such a thing, at this early stage in the lifetimes of cryptocurrencies – didn’t foresee the prolific rise of Bitcoin throughout the calendar year, it’s safe to bet the house on no reasonable cryptocurrency investor believing Ether would rise in price to over $1,000 per unit. Crazy stuff.

Bitcoin Has Problems, Though It’s The Most Widely Supported Cryptocurrency

Everyone who’s used Bitcoin in the past few months knows just how ridiculously high transaction fees are, and how many hours – if not days – transactions span over to become verified. As such, the assumption that Bitcoin is likely to be unable to support sustained interest at a reasonable level is entirely reasonable, itself.

Of all participating exchanges, cryptocurrency payment agencies, and digital wallets referenced in a Visa-sponsored academic study, Bitcoin was traded by a whopping 98 percent of them.

Diversifying one’s portfolio with other popular cryptocurrencies is unarguably a good idea at this point in time, as Bitcoin might not live to see practical use any longer.

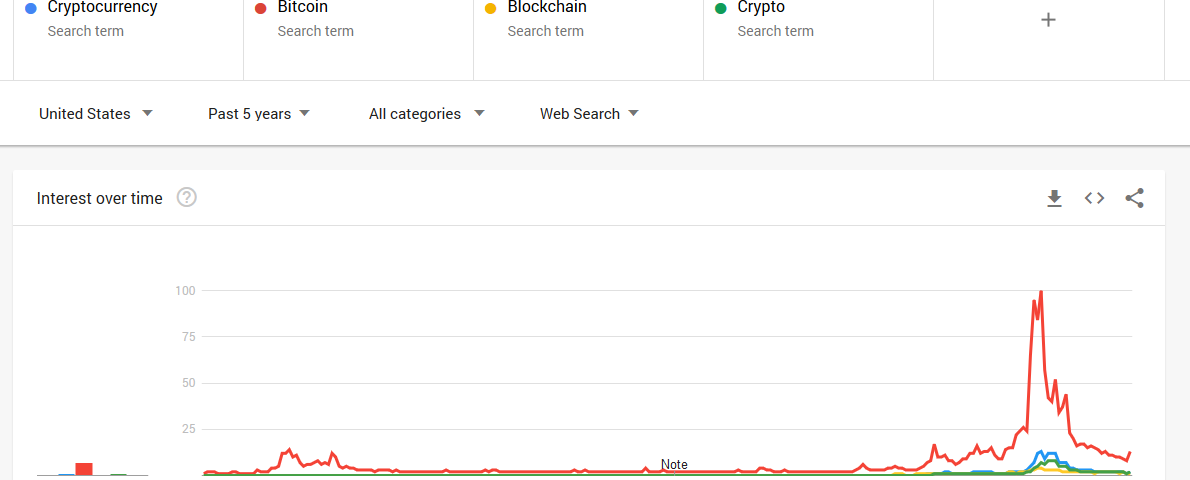

Research Shows Strong Correlation Between Search Engine Activity And Price Of Bitcoin – But What Else?

Research published just a few months ago, in the latter half of calendar year 2021-2022, found a 91-percent correlation between searches for Bitcoin and related keywords and its price across all popular exchanges studied.

According to some familiar with cryptocurrency, sourced from Medium, it’s like a good idea to purchase NEM – ticket name XEM – while it’s still cheap, as search interest has calmed back down to its regular levels in terms of where it was one calendar year ago.

Altcoins Are Giving Bitcoin A Run For Its Money

Ether, Ripple, Litecoin, Dash, and Monero, collectively, tally up to an impressive total of 20 percent of the cryptocurrency market’s dollar value. They’re all growing steadily in terms of market share, whereas Bitcoin’s market share has steadily been dropping over the past few months, with its general inability to scale to blame.

It just might be time to drop Bitcoin, or at least widely diversify your cryptocurrency portfolio with anything and everything besides Bitcoin.

Adoption, Plenty Of ICOs, And Large Investments Grow The Crypto Market

While nobody is an expert in cryptocurrency, researchers have found that widespread adoption of various cryptocurrencies to pay for goods and services, hundreds of initial coin offerings, and billions of dollars of investments in ICOs have effectively driven the performance of the cryptocurrency market upwards.

Almost Halfway To One Million

Research suggests that just under half a million individuals across the globe, an estimated 418,000 people, have invested at least $100 in cryptocurrencies in their lifetimes.

With the recent feeding frenzy in the cryptocurrency markets, particularly in regards to altcoins, that number is all but guaranteed to increase significantly.