Diamond Statistics

Country With World’s Largest Diamond Reserves: Russia

Currently, Russia holds the world’s largest diamond reserves. Researchers estimated the value of Russia’s natural diamond reserves at around 650 million carats, which is far ahead of any other country in the world. In second place is the Democratic Republic of the Congo at 150 million carats. This means that these two countries hold the largest natural diamond reserves; it does not, however, mean that they are the world’s top producers of loose diamonds for sale.

Diamond Stats

Russia produces the largest amount of the world’s diamonds. Last year, Russia mined 18 million carats of diamonds, while Australia came in second place, at 14 million carats.

Industrial Diamond Facts

World’s Largest Synthetic Industrial Diamond Producer: China

As far as synthetic industrial diamonds go, China is currently the world’s largest producer. In 2020, China’s production of synthetic industrial diamonds was over 4 billion carats. Synthetic industrial diamonds are used in construction equipment such as drills and saws. Generally, synthetic diamond materials have a higher demand than that of natural diamond products, and the United States is one of the world’s largest consumers of synthetic industrial diamond. This is due to the US’s use of synthetic diamonds on construction equipment, for the building and repairing of the national highway system. The United States, in addition, is one of the world’s leading producers and exporters of synthetic industrial diamond.

Demand Is Increasing, But For a Smaller Range of Diamonds

The Rapaport Diamond Price Statistics Report concluded that select types of diamonds have seen more of a shortage recently than other types of diamonds. This shows that consumers of diamonds have become more and more particular about the stones they buy. Diamond consumers are buying more diamonds, but not more of all diamonds– only select, particular diamonds. The Rapaport Diamond Price Statistics Report is conclusive for the year of 2017, and reports the progress and performance of the diamond market in the past year and throughout a period of up to 39 years.

Diamond Prices Were Stable During the Holiday Season

This January, it was reported that December’s diamond prices were very steady in the United States. The holiday season in the US was better than expected, economically. Disposable income in the US was boosted by a tax overhaul, as well as economic growth and rising stock markets. This means that 2018 began with a positive outlook for diamond markets; more Americans have more disposable income to spend on the jewels they want. The demand for diamonds and online diamond sales will continue to grow in 2018.

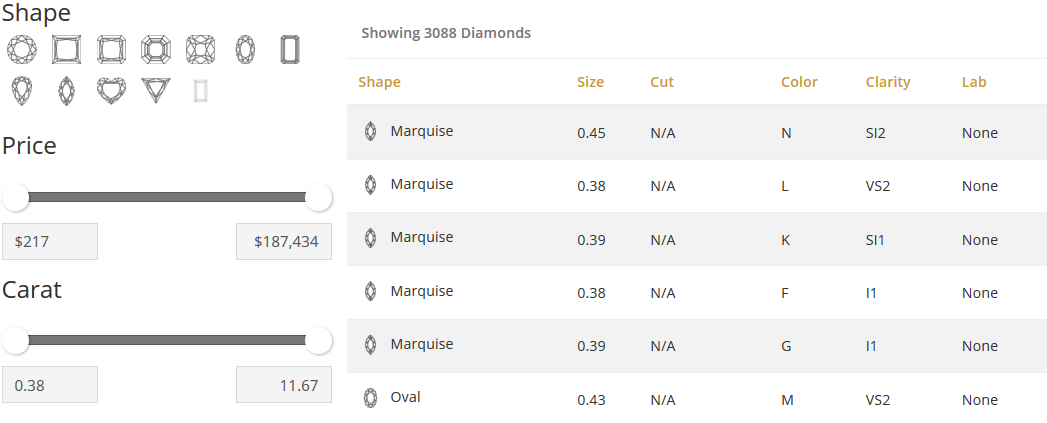

Demand for Different Types of Diamond Cuts

There is a mixed demand for fancy diamond shapes. Currently, as of today, curvy-shaped diamonds are doing better on the market than square-shaped diamonds. Oval and marquise shapes are currently the most popular shapes on the market, followed pears and cushions, then emeralds and radiants. Princess-cut diamonds have a weak demand at this time. Oversized diamonds, on the other hand, are in great demand. Fancy shapes that are cut poorly are currently very difficult to sell, even at a low price.

Increase in US Polished Diamond Imports

This past January, the US saw an increase in the price of imported polished diamonds. Total polished diamond import trade grew by 3%. While the volume of imported polished diamonds was knocked -4%, the overall price of polished imports went up by 7%, making it a total increase of 3%. The average price of polished imports is currently at $2252 per carat.

As far as exports, polished diamond exports are up by a whole 22%. Rough diamond exports, on the other hand, are now down by 73%.

The net diamond account of the US, which is the US’s total rough and polished imports minus its exports, is now down by 43%. The US’s net diamond account is currently at $331 million.